Iron ore price boom expected to send more royalties into WA’s coffers as year end approaches

Article by Sean Smith courtesy of The West Australian

WA’s budget surplus is climbing towards $4 billion as iron ore stretches its unexpectedly strong run into the last quarter of the financial year, potentially pumping another $800 million into government coffers.

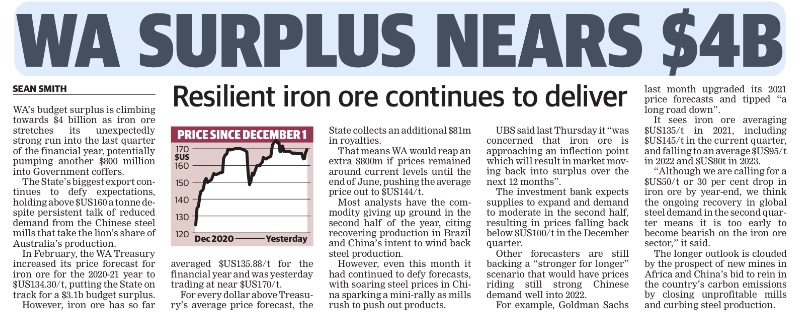

The State’s biggest export continues to defy expectations, holding above $US160 a tonne despite persistent talk of reduced demand from the Chinese steel mills that take the lion’s share of Australia’s production.

In February, the WA Treasury increased its price forecast for iron ore for the 2020-21 year to $US134.30/t, putting the State on track for a $3.1b budget surplus.

However, iron ore has so far averaged $US135.88/t for the financial year and was yesterday trading at near $US170/t.

For every dollar above Treasury’s average price forecast, the State collects an additional $81m in royalties.

That means WA would reap an extra $800m if prices remained around current levels until the end of June, pushing the average price out to $US144/t.

Most analysts have the commodity giving up ground in the second half of the year, citing recovering production in Brazil and China’s intent to wind back steel production.

However, even this month it had continued to defy forecasts, with soaring steel prices in China sparking a mini-rally as mills rush to push out products.

UBS said last Thursday it “was concerned that iron ore is approaching an inflection point which will result in market moving back into surplus over the next 12 months”.

The investment bank expects supplies to expand and demand to moderate in the second half, resulting in prices falling back below $US100/t in the December quarter.

Other forecasters are still backing a “stronger for longer” scenario that would have prices riding still strong Chinese demand well into 2022.

For example, Goldman Sachs last month upgraded its 2021 price forecasts and tipped “a long road down”.

It sees iron ore averaging $US135/t in 2021, including $US145/t in the current quarter, and falling to an average $US95/t in 2022 and $US80t in 2023.

“Although we are calling for a $US50/t or 30 per cent drop in iron ore by year-end, we think the ongoing recovery in global steel demand in the second quarter means it is too early to become bearish on the iron ore sector,” it said.

The longer outlook is clouded by the prospect of new mines in Africa and China’s bid to rein in the country’s carbon emissions by closing unprofitable mills and curbing steel production.